WASHINGTON, Nov. 28 (Xinhua) -- The U.S. Federal Reserve on Wednesday warned of the main vulnerabilities facing the U.S. financial system, including elevated asset prices and the historically high debt owed by U.S. businesses.

"Valuation pressures are generally elevated, with investors appearing to exhibit a high tolerance for risk-taking, particularly with respect to assets linked to business debt," the Fed said in its inaugural financial stability report.

While household borrowing has risen roughly in line with incomes, debt owed by businesses relative to gross domestic product (GDP) is "historically high" and there are signs of "deteriorating" credit standards, the report said.

Drawing lessons from the 2008 global financial crisis, the semiannual report, which includes a summary of the Fed's framework for assessing the resilience of the U.S. financial system, represents the central bank's latest effort to strengthen financial monitoring.

"We have developed a framework to help us monitor risks to stability in our complex and the rapidly evolving financial system," Fed Chairman Jerome Powell told the Economic Club of New York on Wednesday.

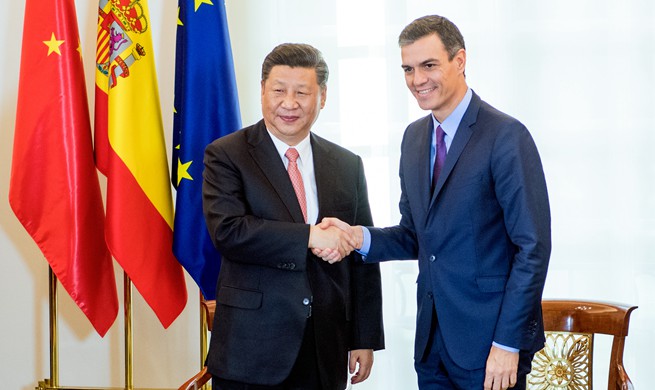

The report also identified external risks, including potential spillover effects from Brexit and eurozone fiscal challenges, slowing-down growth in emerging market economies, trade tensions and geopolitical uncertainties, which could lead to "a decline in investor appetite for risks in general."

"Markets and institutions that may have become accustomed to the very low interest rate environment of the post-crisis period will also need to continue to adjust to monetary policy normalization by the Federal Reserve and other central banks," the report said.

Powell also noted that it is important to distinguish between market volatility and events threatening financial stability.

"Large, sustained declines in equity prices can put downward pressure on spending and confidence," he said. "From the financial stability perspective, however, today we do not see dangerous excesses in the stock market."