BEIJING, Jan. 7 (Xinhua) -- The Chinese central bank's recent decision to lower the level of cash that lenders must hold as reserves will help channel funds into the real economy, economists have said.

The People's Bank of China (PBOC) announced Friday that it will cut the reserve requirement ratio (RRR) for RMB deposits by 1 percentage point. It will reduce the RRR by 0.5 percentage points on Jan. 15 and Jan. 25, respectively. In addition, the medium-term lending facility that will mature in the first quarter of 2019 will not be continued. The move will unleash about 800 billion yuan (116.6 billion U.S. dollars) of capital into the market.

Economists believe such a move will effectively increase loan funding sources of small, micro and private businesses and boost confidence in the economy, but should not be interpreted as a kind of quantitative easing (QE).

"National Bureau of Statistics data showed that the official Purchasing Managers' Index (PMI) fell to the boom-or-bust line of 50 in November, a new low in 2018, signaling entrepreneurs' lack of confidence toward the market," said Gong Yuhang, an economist.

Gong attributed the confidence shortage to reasons including heavy taxes and financing difficulties for enterprises, according to a People's Daily report Monday.

Different from previous RRR cuts, the PBOC's decision this time was announced directly at the beginning of the year, sending a strong signal that the government will address prominent problems in the economy, injecting confidence for entrepreneurs and laying a foundation for the stable run of the economy in 2019, said Zong Liang, chief researcher of Bank of China.

The PBOC said in its Friday announcement that its RRR cut move will also reduce the cost of bank interest payments by 20 billion yuan each year and therefore lower the financing costs of the real economy.

"The RRR cuts at this time will offset liquidity fluctuations caused by cash injections before the Spring Festival this year, and enables financial institutions to strengthen support for small, micro and private businesses, while better serving the real economy," said Zong.

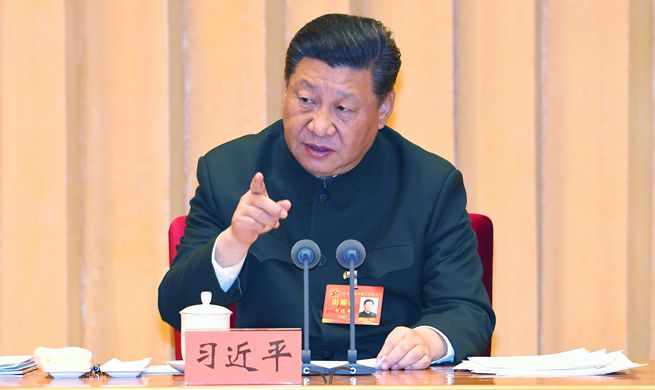

The PBOC's announcement came soon after Premier Li Keqiang called for an increase in financing support for small business during his visit to three large state-owned banks Friday.

Li said the government would stick to the underlying tone of seeking progress while maintaining stability, maintain the consistency and stability of the macro policy, and enhance counter-cyclical adjustments. Policy support might include tax reduction, across-the-board RRR cuts and targeted RRR cuts.

Economists agreed that the RRR cuts were in line with market expectations, given the tone-setting central economic work conference in December had set China's monetary policy to be "neither too loose nor too tight" in 2019, which was already a hint that there was room for policy maneuver.

The key for the financial sector to serve the real economy is to cope with the need of keeping economic growth within a reasonable range and stabilizing employment, Li said Friday.